This past week, I took the boys to our local farmer's market. One of the non-food advantages of going there is getting lots and lots of arithmetic lessons. At each stand we stopped at, I had the person at the stand total our purchases, and then I worked with the boys on the "counting up" method of figuring out change back. This was a lot of work for them, but they started getting good at it toward the end.

In total, I plunked down $33 at market, buying1/2 gallon milk, 1 pint yogurt, 2 gallons cider, apples, oregano, plus Zoo Dinner fixings (2 pints cottage cheese, 1 lb animal crackers). That total includes 50¢ for parking and 25¢ to each of the boys for acing the last math question. Proud mama and all that.

I was all set to brag shamelessly about the low weekly total -- had the post all written, in fact -- when my husband toddled off the the grocery store for supplies and came back with a receipt totaling $93. This brings the weekly spending up to $126. Drat. Still, it brings the 3-week average down to $263.

And yet, as I described above, the average spending so far is more than twice $100. How could that be?

The mystery lies in the power of the splurge. Even one big spending spree bumps up the average a lot, in ways that seem invisible to the person who's not watching it.

Think of it. If I'd spent that $577 one week and then bought nothing at all after that, it would still take 6 weeks to get down to below $100/week average. The effect on the checkbook for those 6 weeks is the same as if I'd spent $97 per week on groceries for 6 weeks, but from my own day-to-day existence, I'd think I spent nothing at all for a month and a half (well, except for that one splurge).

This is why just about anyone who writes a book on personal finance starts with the advice: keep track of your spending. Write it down. Tally it. Do not skip this step. You think you know yourself, but you're probably wrong, wrong, wrong.

Of course, I knew all this when I started tracking my spending with a "splurge" week: I'd rather see the average going down than see it jump up. But it doesn't mean I know how this will pan out in the end. I spend a lot of time spending almost nothing. I spend a very little bit of time spending a heck of a lot. I am very probably deluding myself; I know that my perceptions can't be trusted to calculate the long-term average. When it comes to food, I could be full of it (so to speak). It'll be interesting to see what this monitoring reveals.

In total, I plunked down $33 at market, buying1/2 gallon milk, 1 pint yogurt, 2 gallons cider, apples, oregano, plus Zoo Dinner fixings (2 pints cottage cheese, 1 lb animal crackers). That total includes 50¢ for parking and 25¢ to each of the boys for acing the last math question. Proud mama and all that.

I was all set to brag shamelessly about the low weekly total -- had the post all written, in fact -- when my husband toddled off the the grocery store for supplies and came back with a receipt totaling $93. This brings the weekly spending up to $126. Drat. Still, it brings the 3-week average down to $263.

Cute math aside: 263 is, yet again, prime. This is getting eerie. 263 is also unusual in that we cannot express it as the sum of three squares. A cool theorem by a dude named Lagrange says that we can express every integer as the sum of 4 squares (for example, 263 = 2^2 + 3^2 + 5^2 + 15^2, or 263 = 4+9+25+225). But many integers can get away with just three squares. Not so, 263.There's a much more interesting math/personal finance lesson in here. It's my quite-possibly-irrational belief that, on average, our family spends about (or even less than) $100/week on groceries, and so far, the majority of the time I've been keeping track (2 weeks out of 3), we've come close. This week, we spent $126; last week we spent $85. Pretty good, right?

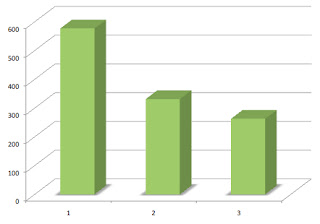

|

| What our family has spent on groceries each of the past three weeks. |

And yet, as I described above, the average spending so far is more than twice $100. How could that be?

|

| The running average of our weekly spending. |

Think of it. If I'd spent that $577 one week and then bought nothing at all after that, it would still take 6 weeks to get down to below $100/week average. The effect on the checkbook for those 6 weeks is the same as if I'd spent $97 per week on groceries for 6 weeks, but from my own day-to-day existence, I'd think I spent nothing at all for a month and a half (well, except for that one splurge).

This is why just about anyone who writes a book on personal finance starts with the advice: keep track of your spending. Write it down. Tally it. Do not skip this step. You think you know yourself, but you're probably wrong, wrong, wrong.

Of course, I knew all this when I started tracking my spending with a "splurge" week: I'd rather see the average going down than see it jump up. But it doesn't mean I know how this will pan out in the end. I spend a lot of time spending almost nothing. I spend a very little bit of time spending a heck of a lot. I am very probably deluding myself; I know that my perceptions can't be trusted to calculate the long-term average. When it comes to food, I could be full of it (so to speak). It'll be interesting to see what this monitoring reveals.

Not that I subscribe to numerology -- far from it. But I just noticed that by Friday of this week, I'll have written 263 blog posts. Nifty coincidence, significant of just about nothing.

No comments:

Post a Comment